Debt Finance is when a business borrows money to fund its operations or growth, usually from a bank, financial institution, or private lender. Unlike equity finance, you do not give up any ownership in your company. Instead, you repay the loan over time with interest, based on agreed terms.

Many small businesses in the UAE use debt finance to manage cash flow, purchase equipment, or expand into new markets. It provides access to capital quickly and can help build a good credit history - so long as payments are made on time.

Debt Finance plays a crucial role in providing SMEs with the capital needed to grow and expand. By borrowing funds, businesses can invest in new projects, increase inventory, or improve infrastructure, which enables them to seize opportunities that might otherwise be out of reach.

Managing debt allows business owners to retain full control of their company. Unlike equity financing, where ownership is shared, borrowing money keeps the decision-making process in the entrepreneur's hands, which means they can remain in charge while still accessing necessary funds.

Taking out debt can help SMEs build their credit rating, which will be beneficial for future financing needs. A good credit history can lead to more favourable loan terms, lower interest rates, and better opportunities for growth, creating a stable financial foundation for the business.

Uncertainty around eligibility can stop you from even applying for finance. Without clear guidance, you might miss out on opportunities that could help your business grow. Delaying funding can lead to cash flow problems or stalled projects. Knowing where you stand and having support in preparing the right documents can be the difference between moving forward or falling behind.

From term loans to working capital facilities, the choices can feel confusing and risky. Picking the wrong option could lead to high repayments, short grace periods, or restrictive terms. Without expert advice, you might commit to finance that does not suit your business model, creating stress, limiting flexibility, and impacting your bottom line.

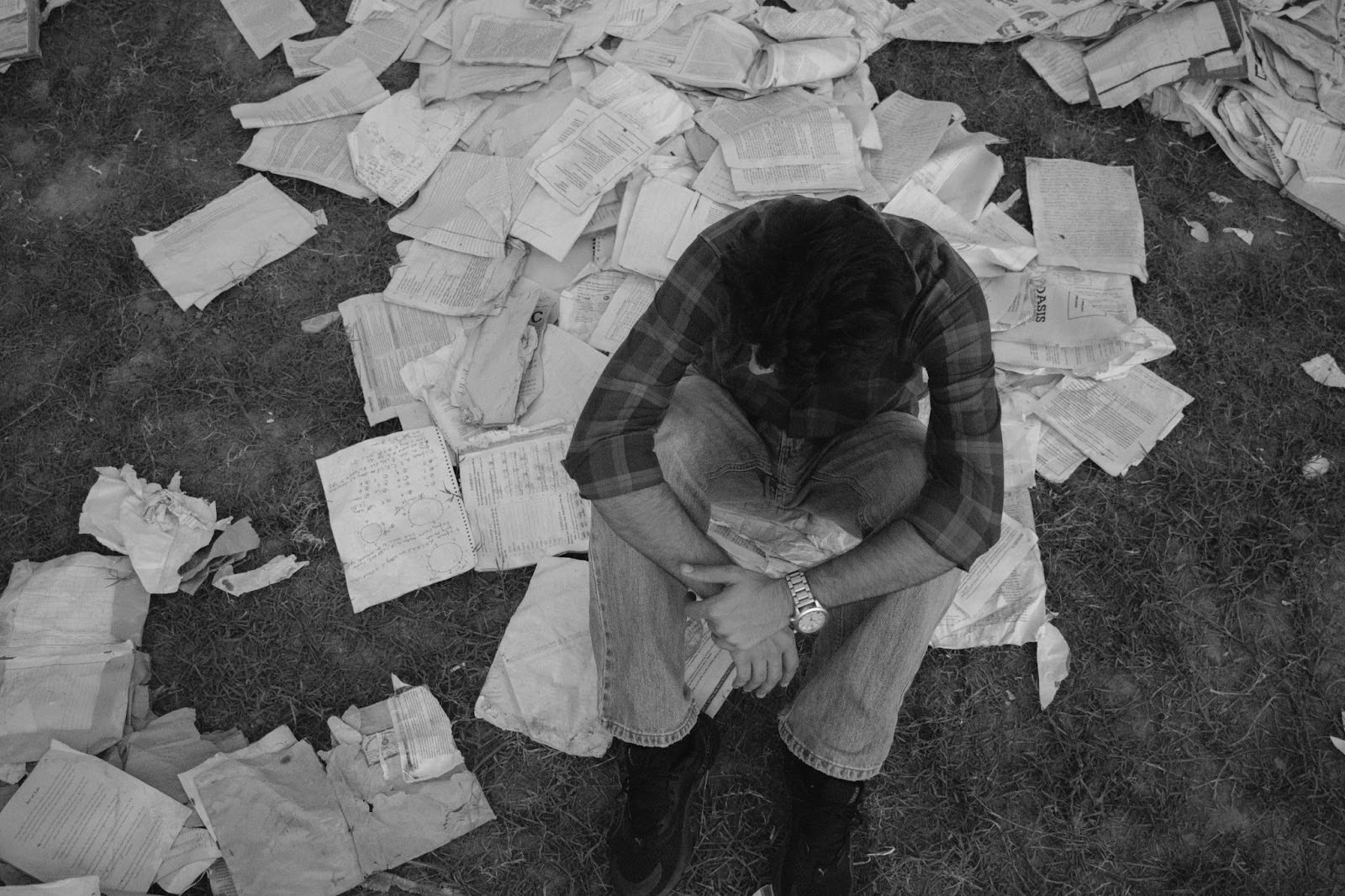

Debt can feel like a burden if you do not have a clear repayment strategy. Without proper planning, monthly repayments can strain your cash flow, causing delays in supplier payments, employee salaries, or growth plans. A lack of structure can lead to missed payments, credit damage, and unnecessary financial pressure.

You may have a clear vision, loyal customers, and a great team, but without access to finance, you cannot scale. This can feel frustrating and demoralising. You risk losing momentum or market share while competitors with better funding move ahead. The right debt support helps you break through growth barriers with confidence.

The process of applying for business finance often feels complicated and intimidating. From preparing financial statements to explaining your business model, it is easy to feel unsure. If you do not get it right the first time, your application might be delayed or rejected, making it harder to access funds when you need them most.

Every financial decision carries weight, especially when you are using borrowed money. Without guidance, you might overestimate your ability to repay, underestimate costs, or miscalculate your break-even point. Poor debt planning can damage your business and personal reputation - something that is hard to recover from in the UAE’s close-knit business community.

As a small business owner or startup founder, it is frustrating to face rejections or vague responses from banks. You have put in the work, but without the right financial structure or guidance, lenders may overlook your potential. This lack of access can stall your plans, hurt your confidence, and leave you feeling unsupported. A strong, professionally presented debt proposal can help change that narrative and open real opportunities.

Navigating through bank requirements, compiling financial documents, and understanding loan terms can be exhausting, especially when you are already juggling daily operations. The fear of missing something important or submitting an incomplete application can delay access to funds. Without expert support, you risk wasting time and missing out on better financing options that could support your growth.

Uncertainty around eligibility can stop you from even applying for finance. Without clear guidance, you might miss out on opportunities that could help your business grow. Delaying funding can lead to cash flow problems or stalled projects. Knowing where you stand and having support in preparing the right documents can be the difference between moving forward or falling behind.

From term loans to working capital facilities, the choices can feel confusing and risky. Picking the wrong option could lead to high repayments, short grace periods, or restrictive terms. Without expert advice, you might commit to finance that does not suit your business model, creating stress, limiting flexibility, and impacting your bottom line.

Debt can feel like a burden if you do not have a clear repayment strategy. Without proper planning, monthly repayments can strain your cash flow, causing delays in supplier payments, employee salaries, or growth plans. A lack of structure can lead to missed payments, credit damage, and unnecessary financial pressure.

You may have a clear vision, loyal customers, and a great team, but without access to finance, you cannot scale. This can feel frustrating and demoralising. You risk losing momentum or market share while competitors with better funding move ahead. The right debt support helps you break through growth barriers with confidence.

The process of applying for business finance often feels complicated and intimidating. From preparing financial statements to explaining your business model, it is easy to feel unsure. If you do not get it right the first time, your application might be delayed or rejected, making it harder to access funds when you need them most.

Every financial decision carries weight, especially when you are using borrowed money. Without guidance, you might overestimate your ability to repay, underestimate costs, or miscalculate your break-even point. Poor debt planning can damage your business and personal reputation - something that is hard to recover from in the UAE’s close-knit business community.

As a small business owner or startup founder, it is frustrating to face rejections or vague responses from banks. You have put in the work, but without the right financial structure or guidance, lenders may overlook your potential. This lack of access can stall your plans, hurt your confidence, and leave you feeling unsupported. A strong, professionally presented debt proposal can help change that narrative and open real opportunities.

Navigating through bank requirements, compiling financial documents, and understanding loan terms can be exhausting, especially when you are already juggling daily operations. The fear of missing something important or submitting an incomplete application can delay access to funds. Without expert support, you risk wasting time and missing out on better financing options that could support your growth.

Running a business without clarity, confidence and control over your finances can

certainly feel overwhelming. Over the years, we have seen and helped many entrepreneurs struggling

with cash flow, profitability, or simply understanding whether they are on track for growth.

In recognition of this pain, we curated a special service - Financial Fitness - to help businesses ensure they not just

surviving, but thriving with the right systems and strategies in place to meet their goals

confidently.

If you would like to see how financially fit your business is today, feel free to click the “+” icon

and take our Free Financial Fitness Assessment. It will only take a few minutes of your valuable

time, but it will help you discover where your business stands, and how you can take your business’

Financial Fitness to the next level.

Finding the right lender can be confusing, especially with so many options available. IFC helps you identify suitable Debt Finance providers based on your business size, industry, and goals. We guide you through comparing loan terms, interest rates, and repayment schedules so you make informed decisions that support long-term success.

We also help prepare and present your financial documents clearly and professionally. This increases your chances of approval and ensures you are showing lenders the strength of your business. With IFC, you’ll feel more confident and prepared when applying for Debt Finance.

Securing finance is just the beginning. IFC continues to support your business with post-loan advisory, helping you manage repayments and integrate them into your overall cashflow planning. This ensures you do not overextend and can grow sustainably.

We also offer financial performance reviews and help you stay on track with your loan obligations. By having a trusted advisor alongside you, you can focus on using the funds to drive real business growth, without the stress of managing it alone.

At IFC, we help you access the right kind of finance without the overwhelm. By simplifying the process and guiding you every step of the way, we ensure you feel confident and in control of your business growth through well-structured funding.

At IFC, client satisfaction is our top priority. Hear from our clients about their experiences and the positive impact our services have had on their businesses. Their testimonials reflect our commitment to excellence, trust, and delivering tech-driven, customised solutions that help businesses of all stages achieve long-term growth and success.

The Budget Masterclass is catered for each individual's business. Each business owner walks away with a fully functional budget based our business's numbers! It was what we needed in order to lay down a solid foundation for 2020.

Thank you for your assistance in the annual audit. We are very happy with your service. It is important to have a good working relationship with your accountants & we certainly feel confident in the advice given.

You and your team have been of constant support by managing our accounting. The icing to the cake is your regular advice & highlighting where we are going wrong & where we could do better. IFC is a great advisory pillar of our business.

IFC has been professional at international standards. They understand the business & guide on how accounts should be recorded & maintained. Pramod's team is spot on in advising on the books & their system enables easy access to data anywhere anytime.

We thank IFC for their professionalism & outstanding financial services. Your help with all aspects of business helped us streamline our accounting process & internal controls. With IFC's help, we created proper budgets and regular tracking.

Thank you for the auditing services provided to our client. We referred IFC, they strategized the deal for getting a Tax Residence Certificate from Ministry of Finance. This was possible with prompt & effective advice, assistance & service from IFC.

For over a year, our books were in doldrums. IFC solved our 15-month backlog with ease & certainty. Now, our system is just remarkable. Your focus on process allows us to establish clear workflows for effective oversight & streamlined operations.

Your advice has worked wonders - doing transformational events rather transactional work. I acknowledge your support & guidance for our outsourced bookkeeping function & creating a financial roadmap. You are a specialist in Accounting for SMEs.

Throughout last year, I have had many clarifications & you have always been there. Furthermore, you have introduced me to some great people along the way. I am eternally grateful & express my sincere gratitude towards IFC.

Debt Finance is money borrowed by a business that must be paid back over time, usually with interest. This can come from banks, financial institutions, or private lenders, and is often used to manage cash flow or fund growth.

Debt Finance gives your business access to funds without giving away ownership. It can be used to invest in equipment, hire staff, expand operations, or manage day-to-day expenses while keeping control of your company.

It depends on your business goals. Debt Finance lets you retain ownership, while investors take a share of your business. If you can manage repayments, Debt Finance is often a faster and more straightforward option.

IFC helps identify the right loan options, prepare the required documents, and manage the application process. We ensure you understand the terms and make informed decisions, saving you time and reducing stress.

Lenders usually assess your business’s financial statements, credit history, cash flow, and repayment ability. They also look for a clear purpose for the loan. Proper preparation and guidance can increase your chances of approval.